کانال کفش و پوشاک و کیف با 70 % تخفیف

کانال دانلود اهنگ های جدید

ارزانترین فروشگاه اینترنتی

کیف ورزشی فقط 25 هزار تومان

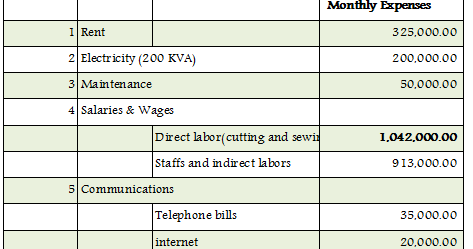

The template provides space to add notes or detailed descriptions as needed. Use this balance sheet template to report your business assets, liabilities, and equity. The template calculates common financial ratios, such as working capital and debt-to-equity ratio. Edit the example line items to list all of your current and long-term assets and liabilities, and view subtotals for each section and column. Record debit and credit transactions in this double-column cash book template to monitor your cash balance. Enter the date, description, and amount for each transaction, and the template will calculate subtotals and total cash balance.

In either case, consider handling the accounting yourself or delegating this responsibility to one or a few of your current employees. Bookkeeping, in the traditional sense, has been around as long as there has been commerce ― since around 2600 B.C. A bookkeeper’s job is to maintain complete records of all money that has come into and gone out of the business.

Find high-quality accounting partners

With records in good shape and neatly organised, you know exactly what is stored where so you save a lot of valuable time. If you’re too busy and approaching tax deadlines, you’ll be thankful that you took the time to keep your records nice and tidy so that you save time by knowing exactly where to look. There’s nothing worse than having to search through too many statements to find one small yet vital piece of financial business that you need. That can often be the case if you haven’t split your personal and business funds, so they’re always combining into one account and it’s easy to lose track. Her work has appeared on Business.com, Business News Daily, FitSmallBusiness.com, CentsibleMoney.com, and Kin Insurance.

CFAs must also pass a challenging three-part exam that had a pass rate of only 39 percent in September 2021. The point here is that hiring a CFA means bringing highly advanced accounting knowledge to your business. A CPA is an accountant who has met their state’s requirements and passed the Uniform CPA Exam. They must also meet ongoing education requirements to maintain their accreditation.

Warnings to small business owners, tax scammers are active as … – WISH TV Indianapolis, IN

Warnings to small business owners, tax scammers are active as ….

Posted: Tue, 15 Aug 2023 19:13:00 GMT [source]

Bookkeepers record daily transactions in a consistent, easy-to-read way. Staying on top of your finances is a key part of being a successful small business owner. Your financial data must be current and accurate so that you have the tools you need to make sound business decisions and implement healthy cash flow strategies. However, most online accounting software applications have made it easy to handle all of the bookkeeping basics your business will need. If you have your bank accounts linked to your accounting software, reconciliation is a quick and easy process. Accrual accounting would record the expense upon receiving the bill.

Accounting software allows you and your team to track and manage your business’s expense reports, invoices, inventory and payroll accurately and efficiently. To choose accounting software, start by considering your budget and the extent of your business’s accounting needs. Accounting software helps business owners understand how money flows in and out of their businesses.

Average cost valuation

While accounting may not be the most exciting part of growing your business, it’s crucial to start off on the right foot. Whether you manage it by yourself, hire someone in-house, or outsource it to a company, having a sound bookkeeping process in place is critical to the management of your business. Selling online requires you to process payments through an integrated payment provider or external software. There’s often a fee for each payment processed, which needs to be tracked and accounted for. Both should give you enough cash to cover your expenses for three to six months.

Here are our top five picks for the best accounting software for small businesses. Now that you’ve balanced your books, you need to take a closer look at what those books mean. Summarizing the flow of money in each account creates a picture of your company’s financial health. You can then use that picture to make decisions about your business’s future. If two sides of the equations don’t match, you’ll need to go back through the ledger and journal entries to find errors.

Monthly bookkeeping tasks

While this is a great opportunity for brands with growth goals, it introduces confusing sales tax regulations that can cause headaches down the line. To simplify things, you can use the cash method throughout the year and then make a single adjusting entry at year end to account for outstanding receivables and payables for tax purposes. Take your business to new heights with faster cash flow and clear financial insights —all with a free Novo account. Sign up for Shopify’s free trial to access all of the tools and services you need to start, run, and grow your business. There are a wealth of ecommerce bookkeeping tools available to help you balance your books and stay on top of your finances, regardless of your experience.

- A strong endorsement from a trusted colleague or years of experience are important factors when hiring a bookkeeper.

- By keeping accurate records, you can make sure your returns are sent off by the deadline and HMRC won’t be chasing you up because of any errors either.

- If Jane buys inventory on Wednesday and her bill is due in 30 days, she’ll record the expense when she pays her bill in 30 days.

- Both should give you enough cash to cover your expenses for three to six months.

- Additionally, the aged accounts receivables and aged accounts payables reports are helpful in knowing which customers have not paid and which vendors are yet to be paid.

Although different in appearance, Kashoo 2.0 still includes the same features but with some new ones added, including bill payment, contacts, accounts, and taxes. For easy bank reconciliation, link your financial institutes with Wave for good expense tracking and month-end reconciliation. Instead of putting it aside to pay later, enter it into your accounts payable to be paid by the due date. Any financial transaction, no matter how small, should be recorded in the proper fashion. Check out the following accounting software you could use to manage your books. If you’re ever in doubt about potential tax obligations, it’s wise to talk to a tax professional.

With many paid and free accounting software options out there, you’re sure to find a bookkeeping solution that will suit your business needs. Next, as a new small business owner, you’ll want to consider a business credit card to start building credit. Credit is important for securing funding, as well as potentially financing large purchase orders in the future. Corporations and LLCs must use a separate credit card to avoid commingling personal and business assets. Financial statements provide a snapshot of your company’s revenue, expenses, profitability, and debt and are an integral part of ecommerce bookkeeping.

How software can help

Sign up to our 30 day free trial so you can try out QuickBooks for your small business before you commit to it. QuickBooks offers a free 30 day trial so you can try our accounting software for your small business before you commit to it. QuickBooks offers accounting software plans to fit your small business budget.

While there is no shortage of accounting and tax tools to choose from, ultimately you want to use a tool you feel comfortable using and intend to use for a long time. You can always switch tools of course, but that can be a timely process you want to avoid where possible. You might have an unexpected downturn in sales due to uncontrollable external circumstances, or maybe you need a financial boost during slow periods in a seasonal business.

You can connect the application with your bank accounts, and Sage Business Cloud Accounting also offers vendor bill management and good financial reporting. You can also track vendor bills and payments in Wave, as well Business bookkeeping as track business expenses by simply snapping a photo of a receipt with your smartphone. If not, you likely can still import your bank statement into your accounting software to simplify the reconciliation process.

The monthly subscription for this software can be upgraded as a business grows. In addition, the mobile app has many customization options that can be used to receive payments, review reports, capture an image of a receipt, and track business mileage. For businesses looking for a payroll solution, QuickBooks Payroll fully integrates with QuickBooks Online.

How To Manage Bookkeeping in 4 Steps

A sale is a transaction you receive cash for, also known as “money in.” QuickBooks Online topped our list because of its scalability, training resources, and mobile app. The Self-Employed Live Tax Bundle also gives you access to a CPA to answer questions throughout the year and during tax season.

- For businesses looking for a payroll solution, QuickBooks Payroll fully integrates with QuickBooks Online.

- A merchant account is a type of bank account that allows your business to accept credit card payments from customers.

- Now that you’ve balanced your books, you need to take a closer look at what those books mean.

- As a business owner, you need to know how much money your customers owe you and how much has been received.

- Our partners cannot pay us to guarantee favorable reviews of their products or services.

You can also integrate QuickBooks with Shopify to stay organized and up to date. It’s important to continually reassess the amount of time you’re spending on your books and how much that time is costing your business. This is why learning accounting basics is so important, even if you don’t intend on always doing the accounting yourself. As a small-business owner, you’ll want to have an understanding of generally accepted accounting principles (GAAP). It’s not a rule, but it helps you measure and understand your company’s finances. This can all get a bit complicated, so check in with your accountant for detailed information about your specific state’s regulations regarding international sales tax.

Join our QuickBooks Community

Every time you perform a financial transaction—for instance, make a sale, accept a client’s invoice, or pay a bill—you should record that transaction in your general ledger. Recording a financial transaction in your general ledger is referred to as making a journal entry. If you’re searching for accounting software that’s user-friendly, full of smart features, and scales with your business, Quickbooks is a great option. This is particularly true once the business accounts for its operational costs and recurring expenses.

We are currently developing a product demo to show you how our banking tools can help you grow your business. They also provide a great resource for potential investors who can see the financials of your business over time. You can calculate COGS by adding the cost of your inventory to the purchases made during a specific time period. Subtract the cost of inventory left at the end of your timeframe to calculate your COGS. This method takes the average cost of all inventory items sold, no matter when they were acquired, and applies this average cost to all inventory.

The major reports to include are the profit and loss, the balance sheet, and a cash flow analysis. Additionally, the aged accounts receivables and aged accounts payables reports are helpful in knowing which customers have not paid and which vendors are yet to be paid. These reports will help you gain greater insights into the financial health of your small business.